Cash Management, Managing Risks, and Profit Allocation.

Cash is needed for many things, such as paying debts, wages, and utility bills, buying raw materials, keeping stock on hand, and so much more. Without having powerful tools like TEP in place, how can leaders in companies decide how much cash to keep on hand for these needs?

The financial manager or CFO evaluates risks an organization faces. This can include market risks, liquidity risks, credit risks, and operating risks. Then, with the live and effortless TEP data, they can quickly create plans for what could go wrong, as well as strategies for circumventing said risks.

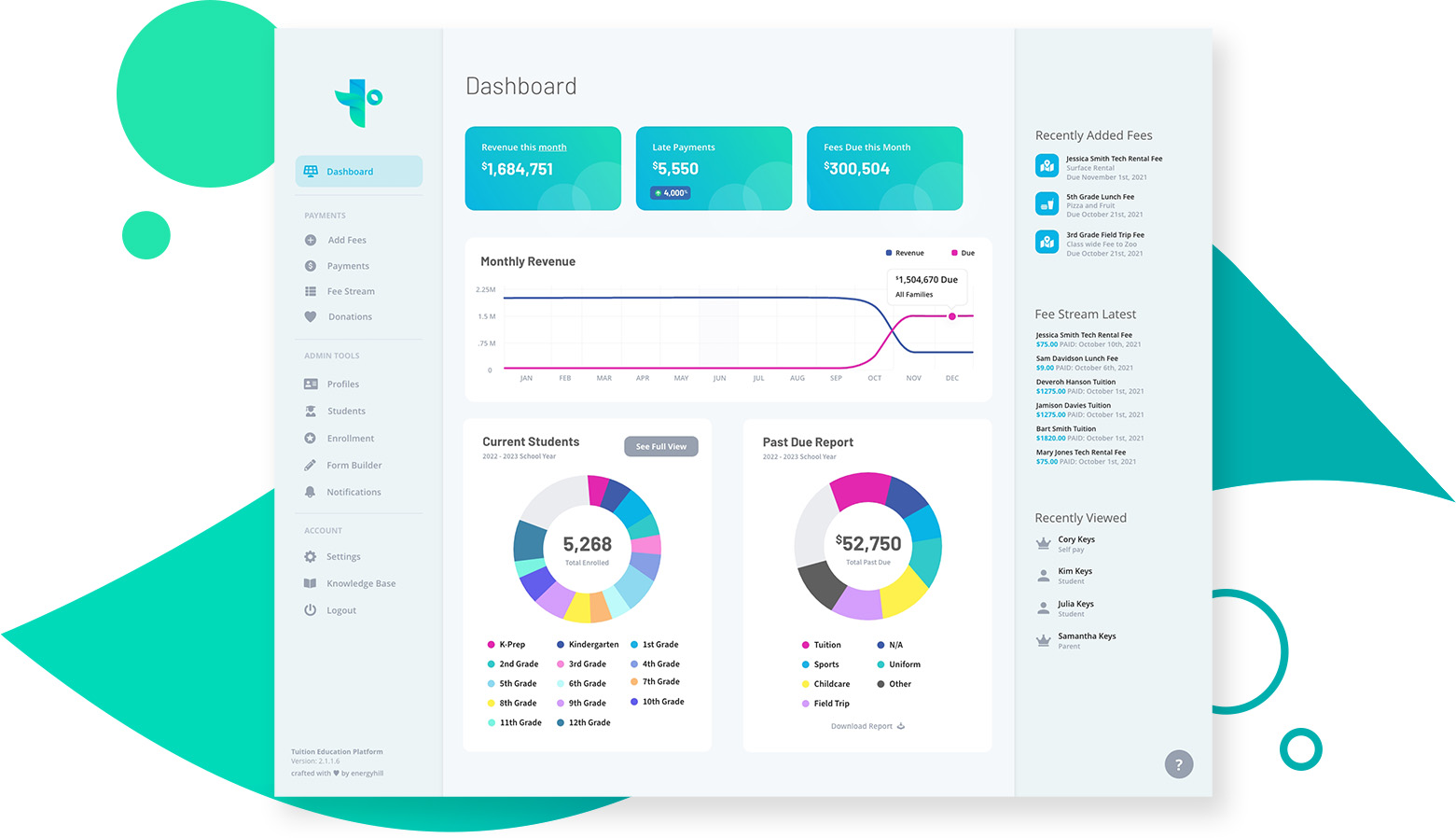

On the TEP dashboard a graph lists revenue, due, and total revenue. This can be exported with one click and full analysis can be done in a matter of moments. An organization can determine profit and allocate to owners for reinvestment opportunities. Although costs are not a focus, TEP allows for quick calculations with ease.